Why is investing better than saving?

Factors such as time horizon, risk tolerance, and financial goals may influence your choice to save or invest. Saving offers low risk and quick access to funds, while investing provides the potential for higher returns and wealth growth.

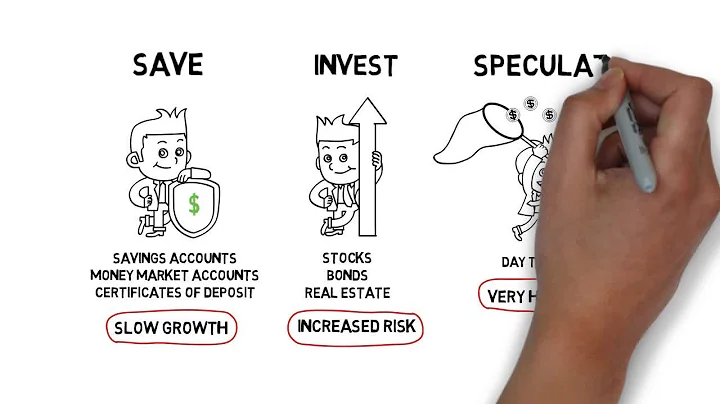

The biggest difference between saving and investing is the level of risk taken. Saving typically results in you earning a lower return but with virtually no risk. In contrast, investing allows you the opportunity to earn a higher return, but you take on the risk of loss in order to do so.

The difference between saving and investing

Saving can also mean putting your money into products such as a bank time account (CD). Investing — using some of your money with the aim of helping to make it grow by buying assets that might increase in value, such as stocks, property or shares in a mutual fund.

Investing is an effective way to put your money to work and potentially build wealth. Smart investing may allow your money to outpace inflation and increase in value.

- Make Money on Your Money. You might not have a hundred million dollars to invest, but that doesn't mean your money can't share in the same opportunities available to others. ...

- Achieve Self-Determination and Independence. ...

- Leave a Legacy to Your Heirs. ...

- Support Causes Important to You.

Savings are not part of GDP or Income.

Hence, If saving exceeds investment, the National Income will remain constant. National income is the total money earned by a country during a given year.

You should invest when you have income, a cash emergency fund, and no high-interest debt. Cash emergency fund. This cash helps you manage the risks of investing. Any asset you buy can lose value or fail to produce the income you expected.

Capital investment allows for research and development, a first step to taking new products and services to the market. Additional or improved capital goods increase labor productivity by making companies more efficient. Newer equipment or factories lead to more products being produced at a faster rate.

Through saving money, your money is kept safe, and easy to access should you need it. By investing early over time, your money grows in value, benefiting from the magic of compounding. Remember that investing early, along with compound interest, can result in higher investment amounts versus a late investment start.

This is taking some of your money and trying to make it grow by buying products that might increase in value over time. For example, you might invest in stocks, property, or shares in a fund. While the gains from investing can be bigger than saving, the value of investments can go down as well as up.

What is risk in investing?

When you invest, you make choices about what to do with your financial assets. Risk is any uncertainty with respect to your investments that has the potential to negatively impact your financial welfare. For example, your investment value might rise or fall because of market conditions (market risk).

Investing in stocks offers the potential for substantial returns, income through dividends and portfolio diversification. However, it also comes with risks, including market volatility, tax bills as well as the need for time and expertise.

Most successful investors start with low-risk diversified portfolios and gradually learn by doing. As investors gain greater knowledge over time, they become better suited to taking a more active stance in their portfolios.

- Stock market investments. ...

- Real estate investments. ...

- Mutual funds and ETFs. ...

- Bonds and fixed-income investments. ...

- High-yield savings accounts. ...

- Peer-to-peer lending. ...

- Start a business or invest in existing ones. ...

- Investing in precious metals.

Key Takeaways

Understand risk, diversification, and asset allocation. Minimize investment costs. Learn classic strategies, be disciplined, and think like an owner or lender. Never invest in something you do not fully understand.

Investing means taking some risk and buying assets that will ideally increase in value and provide you with more money than you put in, over the long term. And while saving offers a guaranteed return (that is, interest on your balance), investing includes the potential to lose money.

For this purpose, high-yield savings accounts are a great option because they come with zero risk — meaning your money will always be there. When you invest, your money can increase or decrease depending on the day-to-day changes in the market, so there is much more risk.

Investing is riskier than saving, but can also earn higher returns over the long term. Even accounting for recessions and depressions, the S&P 500 (composed of the U.S.'s 500 largest companies) has averaged just over 11 percent per year in returns since 1980.

With $500 you can afford to buy a lot of different stocks, since many stocks have share prices below that figure. But you won't be able to buy a lot of different stocks at one time. And you won't be able to buy a lot of shares of whatever stock you choose to buy.

On average, the stock market yields between an 8% to 12% annual return. Investing $100 per month, with an average return rate of 10%, will yield $200,000 after 30 years. Due to compound interest, your investment will yield $535,000 after 40 years. These numbers can grow exponentially with an extra $100.

What are the 7 types of investment?

- Mutual fund Investment. As an investor, you have a variety of options to choose from when it comes to parking your funds to generate returns. ...

- Stocks. ...

- Bonds. ...

- Exchange Traded Funds (ETFs) ...

- Fixed deposits. ...

- Retirement planning. ...

- Cash and cash equivalents. ...

- Real estate Investment.

The 50-30-20 rule recommends putting 50% of your money toward needs, 30% toward wants, and 20% toward savings. The savings category also includes money you will need to realize your future goals.

Cash equivalents are financial instruments that are almost as liquid as cash and are popular investments for millionaires. Examples of cash equivalents are money market mutual funds, certificates of deposit, commercial paper and Treasury bills. Some millionaires keep their cash in Treasury bills.

The earlier you start investing, the faster you can grow your money and make it work for you. Inflation means your money is losing value when it's not invested. Saving and investing are different. It's important to do both, for money you may need in the near future (savings) and in the long term (investing).

Are you approaching 30? How much money do you have saved? According to CNN Money, someone between the ages of 25 and 30, who makes around $40,000 a year, should have at least $4,000 saved.